By Joan Koerber-Walker

Everyone needs a helping hand at one time or another. It does not matter if you are young or old, healthy or sick, learning or teaching, wealthy or struggling to make ends meet. We all need help sometimes.

NONPROFITS ARE HELPING-HAND BUSINESSES

Nonprofits are business enterprises that provide needed services to the community and do not return profits back to private individuals, owners or shareholders. In recognition of this service and as long as they follow the many rules that govern them, they are exempt from paying income taxes at the federal and state level.

In addition, donations to nonprofits that have been determined by the Internal Revenue Service to satisfy the requirements of 501(c)(3) status are eligible to accept tax deductible donations. The exempt purposes set forth in Internal Revenue Code section 501(c)(3) are charitable, religious, educational, scientific, literary, testing for public safety, fostering national or international amateur sports competition, and the prevention of cruelty to children or animals.

Not every nonprofit is recognized as a charitable organization by the IRS. For instance, your local chamber of commerce, business society, industry association, or other membership organization may be a nonprofit but is often not deemed a charity by the IRS. However, they often rely on your support.

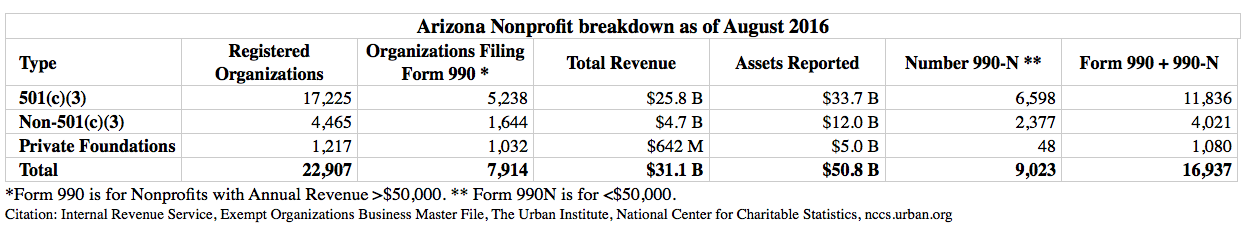

Nonprofits come in all shapes and sizes. Banner Health, the largest non-government employer in Arizona, is a nonprofit. Its annual report lists assets of almost $11.7 billion (December 2017) including the real estate and equipment essential to deliver its mission of “making health care easier, so that life can be better.” The ASU Foundation, one of Arizona’s oldest nonprofits, is a private organization that raises and invests private contributions to Arizona State University. It reported its total assets as over $927.3 million as of June 2017. But for every large nonprofit, there are many smaller ones. Based on 2016 IRS data, approximately 70 percent of Arizona nonprofits are 501(c)(3) charitable organizations, and more that half of all Arizona nonprofits have revenues of less than $50,000 per year.

NONPROFITS NEED A HELPING HAND, TOO

All businesses must stay healthy to survive. This means ensuring the necessary resources to deliver quality products and services. It also requires building up and maintaining reserves for unexpected needs. Nonprofits need not and should not lose money. The Nonprofit Finance Fund’s State of the Sector report revealed “that less than 25 percent of those nonprofits responding had more than 6 months of cash in reserve. In fact, the majority of the responding nonprofits reported that they had less than three months of operating reserves on hand. And close to 10 percent had less than thirty days of cash on hand.” When the unexpected happens, this lack of a rainy-day fund can seriously hurt the nonprofit’s ability to deliver much needed services and in some cases their ability to survive.

IS IT STARTING TO RAIN?

Many nonprofits depend on donations or sponsorships to help underwrite the cost of services they deliver to the community. With the new tax rules that went into effect after the 2017 tax reform law, fewer people are expected to itemize their tax returns beginning in 2018. With the standard deduction increased to $12,000 for individuals and $24,000 for people filing jointly, it is estimated that the number of people who itemize their taxes will drop by more than 50 percent. Only people who itemize can claim the charitable deduction. This also impacts businesses that are reported to the IRS as sole proprietors, partnerships and S-corps because the charitable contribution flows down to the individual owners. This has many 501(c)(3) nonprofits worried that they may have to cut back on services over time if the tide of charitable giving in the U.S. starts to ebb.

HOW YOU CAN LEND A HELPING HAND

Volunteer – Sharing your time and experience can make a major impact. According to The Corporation for National & Community Service in 2015, Arizona nonprofits reported support from 1,229,997 volunteers and 174.36 million hours of service for a total of $4.5 billion of service contributed. While this is significant, only 23.3 percent of Arizonans volunteer, ranking us 38th in the nation.

Donate based on impact, not just tax deductions – With more than 23,000 Arizona nonprofits to choose from, there is likely an organization with a mission that matches the things you care about. Do your homework, understand the impact your donation can make, and give what you can.

Inspire the next generation of donors and volunteers – Many of the habits and behaviors we learned as kids stay with us throughout our lives. Help shape the next generation of donors and volunteers by engaging the young people in your life with nonprofits early. Making a better Arizona starts with each of us, not just with our nonprofits. When we support them, they can support us. After all, we never know when we might need a helping hand.

LEARN MORE ABOUT SUPPORTING NONPROFITS

- Arizona Tax Credits

- Arizona Alliance of Nonprofits

- ASU Lodestar Center for Philanthropy & Nonprofit Innovation

- Guide Star

- IRS Look Up

Joan Koerber-Walker serves as president and CEO of the Arizona Bioindustry Association and has lived in the Valley of the Sun for more than 25 years.